- App Platform

- Pricing

- References

-

Apps as a Service

-

Mobile App as a Service

Get a tailored app done for you

-

Convert website into app

Convert website into appGet an app prototype in 2 minutes

-

Contest Voting App

Boost your voting contest with an app

-

Pageant Voting System

Create a flashy app for your pageant

-

Fan engagement app

Grow your fan engagement with an app

-

News app

Grow engagement with your readers

-

Event app

Engage your attendees

-

TV Show app

TV Show appGrow interactions with your viewers

-

- Resources

- Work With Us

sports

Digital Fan Engagement Insights: How Fans Consume Sports Media Today

Want to improve your digital fan engagement? Learn how sports fans really consume sports media in the light of recent research on fans and the sports industry.

Heikki Rotko

May 5, 2023

How should your sports organization drive fan engagement? How do fans truly consume sports media, now and in the future?

This blog post will take a look into how today’s fans engage with sports media on digital platforms.

We’re looking at multiple points of reference to gain good insights of fans' current sports media consumption habits. We’re also comparing that data to the views of professionals working in sports organizations.

Let’s take a look into those questions with data.During the last year, there have been a few relevant studies on the media consumption of sports fans:

- Omdia studied the media consumption of Gen Z (18-24-year-olds) in the United Kingdom in late 2022. The study included a subsegment of sports fans within the generation.

- Yougov studied the media consumption of sports fans in the United Kingdom and the United States in 2022.

On top of this, iSportConnect and us, Choicely, surveyed sports industry professionals on fan engagement. We asked, among other things:

- What digital platforms and media sports organizations prioritize in fan engagement

- What digital platforms sports professionals believe fans use

This “The State of Sports Fan Engagement 2023” study was published in April 2023. Most of the respondents were from the US, with the UK being the second most common residence of the respondents.

These studies provide an interesting starting point for comparisons. So let’s look into the data to get a realistic view on fan behavior, and how sports organizations should adjust.

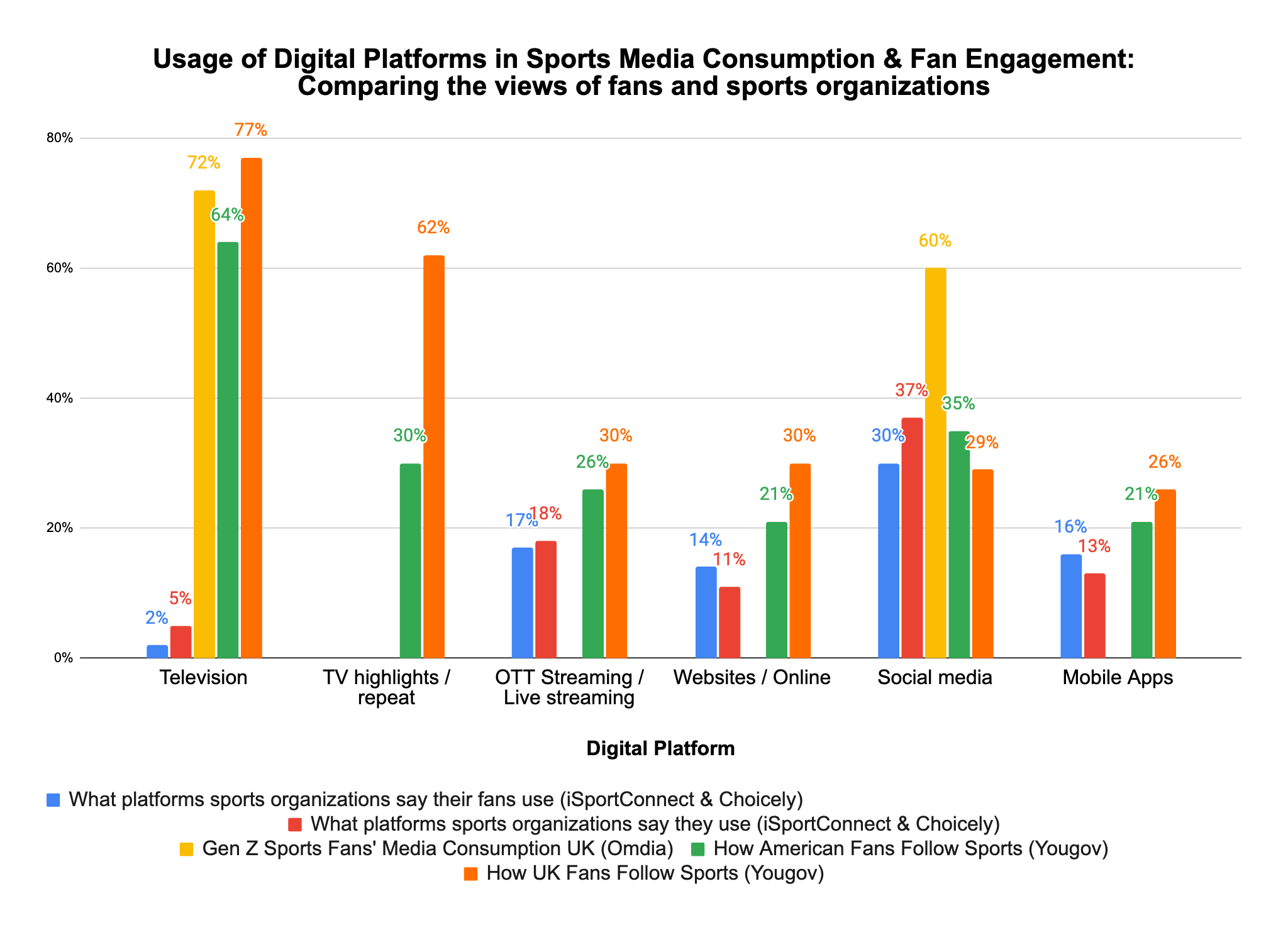

What digital platforms sports fans use vs. what sports organizations think they use

We compiled the data from those studies into a single graph. So let’s have a look at what the data says about the most common fan engagement platforms, and is there a discrepancy between them and what the sports organizations are using.

The way questions are presented differ by study (see the graph), but there are two things we can see right away from the aggregated data:

1. Sports organizations undervalue television massivelyOnly 2% of sports industry professionals think TV is fans’ favorite channel, holding the last place (blue bar). In reality, TV is the clear #1 channel to follow sports both in the US (green bar) and the UK (orange bar). It’s also popular among Gen Z (yellow bar)

2. Social media is the clear favorite for sports business professionals, but in reality TV tops it in consumption

Sports business professionals think fans spend the most time on social media. However, TV is a more important channel and the ‘competition’ is very close between online content, streaming, and mobile apps.

Let’s dig in further. We’re also examining what different pieces of research say about the consumer behavior (or “fan behavior”) beyond this graph.

1. How did sports business professionals get TV so wrong?

Let’s clear up one thing: the role of television in sports media consumption is huge.

Why do I need to clear that up? Because only 2% of sports professionals believed TV is the channel their fans use the most in “The State of Sports Fan Engagement 2023” study. Based on research on sports fans, the sports business professionals couldn’t be more wrong!

In 2023, the role of television remains strong – especially in sports. According to Yougov, television was the most popular channel to follow sports in the UK (with 77%) and in the US (64%). No contest.

Maybe the sports business professionals overvalued other channels like social media because TV is a ‘traditional channel’, which is not used that much by younger generations anymore?

Nope. Watching sports on TV is also popular among younger audiences. According to Omdia’s study on Gen Z, 72% of respondents said they regularly watch live sports on TV at home. Instead of TV, sports professionals see social media as the #1 platform sports fans use.

Fans do in fact spend a lot of time on social media. But it doesn’t stand out in media consumption as much as sports industry pros think.

Tune in to watch some sports on TV, a common habit among fans

Among the general population consumers still spend more time watching television than social media platforms (3 hours 23 minutes, vs. 2 hours 31 minutes).

So ignoring television is a huge mistake in understanding fan behavior, and in creating fan engagement strategies.

The battle of the big screen

Let’s continue on television. People watch television more than ever – not necessarily linear TV, but the screen and device itself.

The TV is used for multiple purposes, on top of linear TV it’s used for accessing subscription services (like Netflix), for social video (like Youtube), for screen mirroring from desktop computers or mobile phones, or for pairing it with other devices like gaming consoles. For example in the US consumers spent 32% of their TV time using TV connected devices in September 2021.

When talking about live broadcasting – the last 10–15 years has witnessed the rise of OTT streaming platforms. Like linear TV, streaming is a natural way for fans to follow sport on any device. According to Nielsen, 40,7% of global fans opt to stream live sports events through digital platforms.

Overall, if talking about video consumption skews significantly towards the smartphone: with 23% preferring it as their primary device – compared to 7% in the rest of the population, according to Omdia.

Television is still the most popular device to access streaming services.

In the UK, streaming is the second most popular digital platform to follow sports, and 3rd in the US. The sports industry professionals know its popularity too, naming OTT Streaming as the second most important digital fan engagement platform.

Gen Z is particularly active in using all kinds of streaming services, whether they’re pay TV services, subscription services, free advertising-based services or a social media video. According to Omdia, Gen Z can have up to 12 different video services in use – that they use at least once a month!

How to use streaming to your advantage?

There are a number of ways to use this information. Streaming makes sense for sports organizations of all sizes.

If you’re a bigger player, bigger sports league, a federation or NGB, the money you get from broadcasting rights is likely a major income for you. Sports broadcasting rights are also a major driver of revenue for the broadcasters. For example, 1/3 of TV ad revenues depend on live sports programming – although sports consists of only 8% of the viewing. Also, 30% of video service subscriptions of Gen Z in the UK are driven by sport (Omdia). Keep these facts in mind when negotiating broadcasting rights.

For sports leagues, federations or NGBs of all sizes it’s also worth considering to offer your own live streaming in direct-to-consumer (DTC) model to maximize the reach and coverage of your sport. If you want to explore it, don’t make deals that give out exclusive rights to your own sports content.

The DTC approach is even more relevant to smaller players. If you don’t get any income from selling broadcasting rights, and you have a smaller budget, don’t worry: setting up your own channels for live streaming is more cost-efficient than ever. You can offer paid subscriptions to get extra income, or offer a free live stream to maximize your reach. Exploring a Uscreen OTT alternative can provide more flexible features or pricing, helping you tailor your streaming platform to your audience’s needs.

For example, Helsinki cup, the 3rd largest junior football tournament in Europe, offers fans a live stream through their app in exchange for a small fee. The International Judo Federation on the other hand caters their app users with a free live stream during their events.

The Key Is to Thrive On the Ecosystem of the Screens

Television and live streaming are the best ways to follow a live sports event. However, they’re not the only digital platforms that fans use during the broadcast.

Fans have other devices at hand during the broadcast. Whenever there’s a break, or a less eventful moment, people tend to reach out to their phones, or other devices.

They’ll start browsing online content, run errands, et cetera – during the broadcast. This behavior or phenomenon is called ‘second screening’.

This graph from Nielsen shows what fans regularly do while watching sports:

As we can see, second screening is clearly stronger among Gen Z. Also Omdia’s research on Gen Z proves the same point.

In Nielsen’s study we looked at fans’ regular second screening behaviors. Overall, 96% of sports fans have used another device for second screening, according to GWI. 74% had reached for their phone. This publication was from 2017.

How to make the most out of fans' second screening?

Essentially there’s no one digital fan engagement platform, device, or screen to rule them all – but many, intertwined. You need to tap into the fan behavior, and offer sports content the best way possible, suiting each situation.

Second screening is a clear opportunity for sports organizations. Obviously, you’ll be providing your sports event – but on top of that you should cater to the fans’ information and entertainment needs during and between your events.

It’s for sure that even during something as thrilling as a sporting event, a fan might get distracted and start browsing. What will they browse? Will it add to the fan experience? Or away from it?

According to Nielsen’s graph, apps are the most popular means for second screening. Do you want to maximize your interactions with fans? Then make an app that adds to the sports event experience – the app they use could be yours.

Provide sports content that adds to the fan experience – in multiple channels, in multiple formats – depending on what the fans need.

The behavior of the younger generations shows this is the way of the future. What they do now is a standard in 10 years, and the progress will accelerate. Strive to keep your audience engaged in your own channels. The connection between the sports event, content and engagement needs to be strong and compelling.

Optimizing the Fan Experience on The Smaller Screen

Television and OTT live streaming are the most common ways to follow the actual sports event live. What about the other, smaller screens? How do fans use them?

Social media: the most obvious fan engagement channel

It’s self-evident for sports business professionals that social media plays a major role with sports fans: they saw it as the #1 channel fans use in “The State of Sports Fan Engagement 2023”, study by iSportConnect and Choicely.

Like previously mentioned, social media isn’t as clear number one as the sports business professionals thought – it’s rather 2nd or 3rd behind TV and streaming, in close ‘competition’ with online content and mobile apps.

Social media sports content usage is important especially among Gen Z. According to Omdia’s research up to 60% of Gen Z sports fans of that generation follow teams or players on social media.

This younger generation also watches videos primarily through social media: YouTube, TikTok and BBC iPlayer are the Top3 video channels where Gen Z consume video content in the UK.

Source of images: Omdia.

Fans also embrace social media for ‘second screening’. According to the Nielsen’s graph earlier, 43% of Gen Z browse social media while watching live sports. Also, 32% of the general population consume social media content while watching.

How to leverage social media?

Sports organizations are well-aware of the importance of social media. How to use this information is also clear-cut based on the data:

- Place a big emphasis on social media, and especially on video content: serve fans with live streams, highlight clips, interviews, analysis, opinions, full matches.

- Offer social media content that adds to the fan experience – during live events or in-between them: do live posting during events, ask and give room to reactions and opinions from fans, offer interesting facts and statistics.

- Establish ways to follow your organization, team, players or athletes. Be active, and show your brand identity, engage with your fans and bring the sport closer to them.

The center of fan engagement: mobile apps or websites?

Whether looking at fans’ actual sports media usage, or views of the sports industry professionals, mobile apps and websites (or online content) rank very close to each other in popularity.

These digital platforms are also often compared to each other.

For second screening, the smaller screen is usually the smartphone – and there are almost 7 billion smartphone users in the world in 2023, about a billion shy of the world population.

And within smartphones, apps have the advantage as they are the native software of smartphones. Mobile apps have truly become a formidable force in global media consumption. They are used 4,5 hours a day, as a global average.

Mobile app usage is also fans’ most common activity when watching sports, according to Nielsen. The effect is even more pronounced among Gen Z fans. 26% of UK sports fans use apps to specifically follow sports – a number that will only increase as the supply of sports apps grows.

Smartphones are also a popular “first screen”, especially for Gen Z who consume videos in the smartphones more than the general population (23% Gen Z vs. 7% the rest).

Mobile video is trending among younger generations

In a sense, apps are more rare than websites or social media channels – which basically all companies have. Despite that, mobile apps are pretty much as popular sports media consumption, and in the fan engagement strategies of organizations.

Sports professionals named mobile apps as the 3rd most important sports fan engagement channel in our study, behind social media and streaming, and just ahead of websites.

How to provide the best experience through apps and websites?

There’s no contest between apps and websites, although they’re often ‘pitted’ against each other.

Use your website as a central place to store all your content: videos, statistcs, articles. Use it for monetization: offering ticketing and merchandise. Have fans easily find your website online.

Mobile apps on the other hand are a premium experience for a fan – it also means not every fan will download it, but those who will are more likely to be passionate, engaged fans who are also more willing to spend money on your sports brand.

Self-proclaimed “fanatic” fans by the way use 6X more annually than casual fans, according to Deloitte. When it comes to second screen behavior, apps are the most pronounced platform used for ‘second screening’.

Build your mobile app into a premium ‘360 fan experience app’ to be used during and in between sports events and broadcasts. Aggregate content from all your channels: bring all relevant content from your website including ticketing and merchandise stores - and social media. You can also offer live streaming to serve the needs of younger audiences who like to watch video on their phone.

Find more tips on growing digital fan engagement with mobile apps here.

Some monetization features of a fan engagement app

On top of these features apps offer vast opportunities when it comes to features to engage with your fans, from votes, ratings, surveys and gamification features, to state-of-the-art experiences powered by AI or AR solutions.

While fans are watching your match, and see an announcement of the next match, the easiest way for the fans to purchase the tickets to the next game is to open your app on the home screen and click on the ticket store.

Want to learn more about Growing Digital Fan Engagement & Revenue with Apps? Learn more about our comprehensive 34-page ebook and download it here:

Conclusion

For any sports organization, the biggest takeaway from research is that fans use multiple digital platforms when they consume sports, and they use these devices in tandem.

There’s nothing new in this message though – in fact, these things have been talked about for the last 20 years. Now the technology is ready, and provides fantastic possibilities.

The added value of the second screen can be done better than it has been so far – there are more opportunities to be unlocked. Do the fundamentals well first: offer a combination of sports content the fans need, packaged in a user-friendly way. Then expand the fan experience you provide to new digital territories, and emerging technologies like AI or AR solutions.

If we look at the ways how Gen Z consumes media to predict what happens in the next few years, sports will be consumed even more:

- on multiple screens and services

- directly on social media, especially in video format

- and through mobile devices.

It’s time to get to work!

Get started by downloading our eBook on Digital Fan Engagement:

Keep reading, here are some similar posts

Fan engagement has been a well-known concept for a long time. Sports teams and athletes have engaged with...

How do our fans consume sports media? It’s a question that sports organizations should ask on a regular...